Iron Mountain, MI Investor Takes on Big Pharma Over Cancer Drug Profits

Marquette, MI federal lawsuit: Oncology drug Onconase trials for the “treatment of patients with Non-Squamous, Non-Small Cell Lung Cancer”

James O. McCash, Plaintiff

http://david-mccash.lpladvisorsites.com

v.

Tamir Biotechnology, Inc., Defendant

http://tamirbio.com

Suit by Iron Mountain investor involves the Onconase oncology platform, trials and profits

Fight over profits and agreements involving vivo antiviral studies

By Greg Peterson

U.P. Breaking News

Owner, News Director / 1-906-273-2433

(Marquette, MI) – A five-old dispute over the financial investment and control of a multi-million dollar cancer drug – found in the Northern Leopard Frog – has grown into a federal civil suit filed against a biotechnology company with the charges made by an investor/shareholder who runs an investment firm in Iron Mountain, MI.

The suit was filed by James O. McCash of N3820 South Grand Oak Drive in Iron Mountain, MI. The defendant is a biotechnology company – Tamir Biotechnology, Inc. (Scroll to end to see additional information about both).

At issue is the development of an anti-viral use for Onconase and related medical trials of the cancer drug. The drug is for patients with “non-squamous, non-small cell lung cancer.”

The suit makes six serious charges: Breach of Contract, Unjust Enrichment, Innocent Misrepresentation, Negligent Misrepresentation, Promissory Estoppel, and Intentional Misrepresentation.

The suit – while in common legal language stating over $75,000 in damages – describes in detail damages worth over $1.1 million dollars. In fact, the suit asks for additional monies as a penalty for the alleged actions of the company.

“McCash’s loss benefited Tamir, the suit states.

The suit requests a jury trial – and states that “James O. McCash demands a judgment” from this Court ordering” a “judgment against the Defendant for its actual damages, including direct and indirect damages, general and special damages, legal and equitable damages, consequential damages, damages relating to lost profits and punitive damages.”

McCash also wants the company to pay for all “court costs, fees and disbursements, including reasonable attorneys’ fees incurred.”

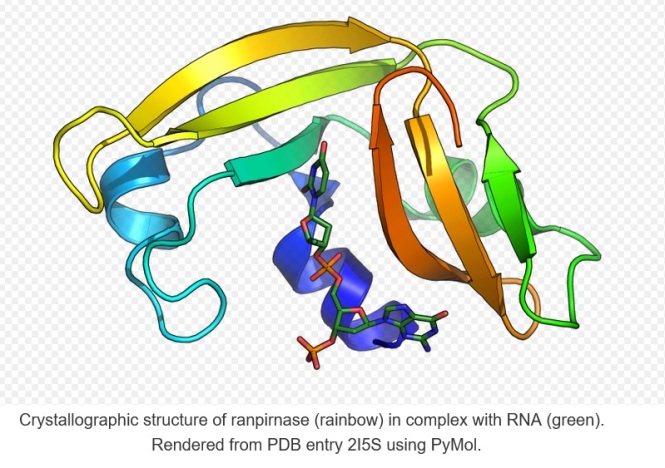

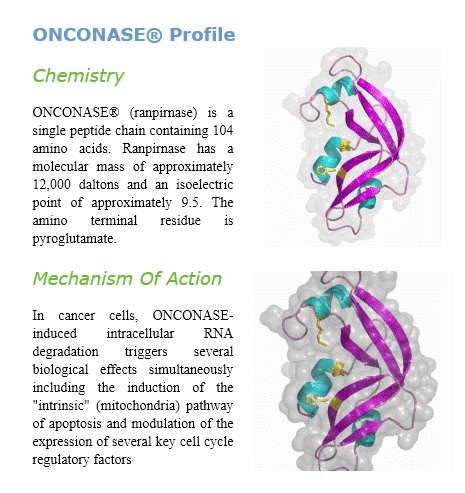

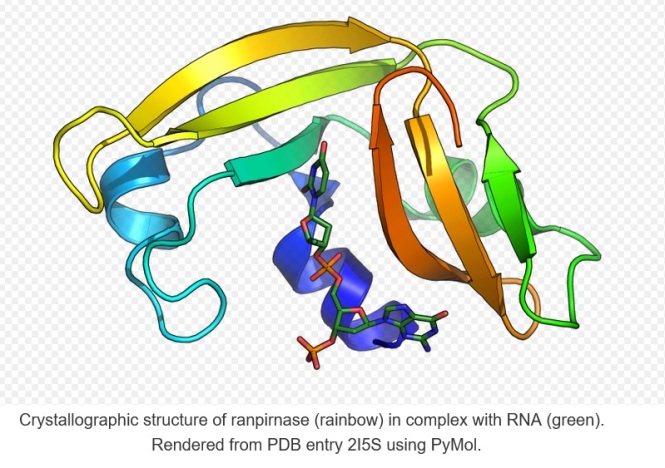

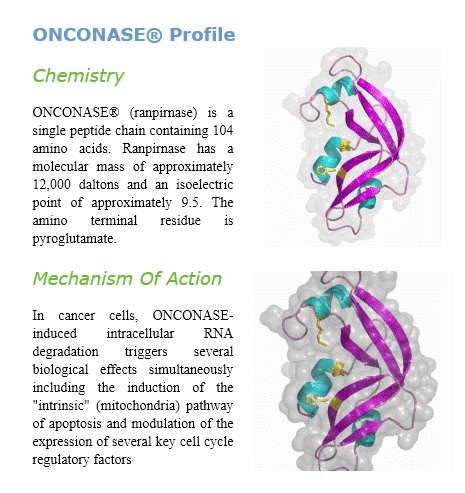

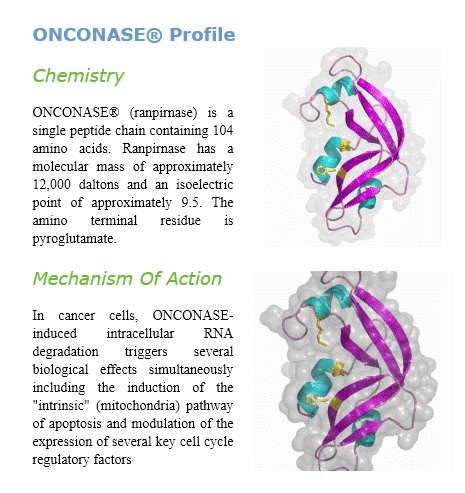

Onconase is also known as Ranpirnase, a ribonuclease enzyme found in the oocytes of the Northern Leopard Frog (Rana pipiens).

Northern Leopard Frog:

Northern leopard frog

Amphibians

The northern leopard frog is a species of leopard frog from the true frog family, native to parts of Canada and United States. It is the state amphibian of Minnesota and Vermont. WikipediScientific name: Lithobates pipiens

Rank: Species

Clinical trials under the brand name Onconase

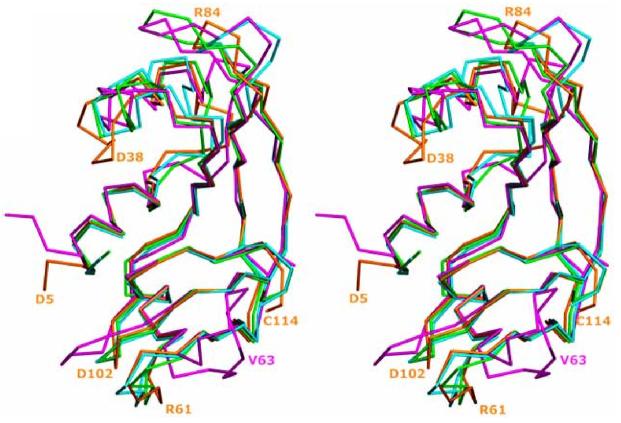

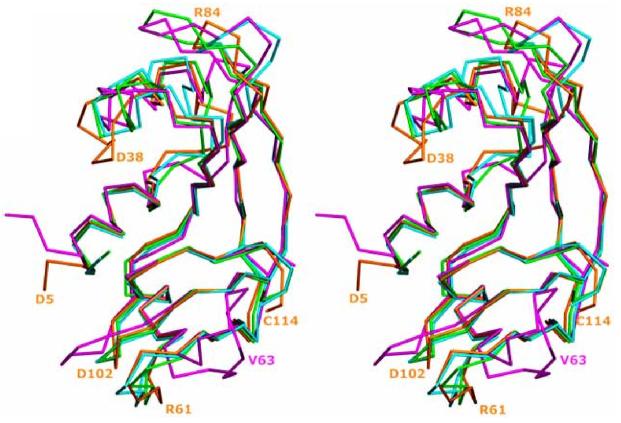

Ranpirnase was originally discovered by scientists at TamirBio, a biotechnology company (formerly Alfacell Corporation), where it was tested in clinical trials under the brand name Onconase. The mechanism of action of ranpirnase tumor-selective cytotoxicity has been attributed to the RNA interference pathway, potentially through cleaving siRNA molecules;[3] to cleavage of transfer RNA;[2] and to interference with the NF-κB pathway.[4] Despite early indications of promise as a mesothelioma treatment,[5][6][7] and an orphan drug status designation from the United States Food and Drug Administration in 2007,[8] the Phase III clinical trial for this indication did not demonstrate statistical significance against primary endpoints.[9]

McCash has been a Tamir “investor and shareholder for many years,” the federal civil suit states.

McCash is represented by Brandon J. Evans of the Marquette firm Kendricks, Bordeau, Adamini, Greenlee & Keefe, PC; and attorneys George S. Peek and Richard T. Orton for Crivello Carlson, S.C. in Milwaukee.

Tamir Biotechnology, Inc. (Alfacell Corporation) is a corporation under the laws of Delaware – and it’s principal business is at 12625 High Bluff Drive in San Diego, CA.

In October 2009, McCash and others financed “Tamir to initiate a Phase II trial of the oncology drug Onconase – in relation to the treatment of patients with Non-Squamous, Non-Small Cell Lung Cancer.”

After that October 2009 financing, Tamir refocused its efforts on the “development of an anti-viral use for Onconase, contrary to the express purpose of the financing and to the detriment of the Phase II trial.”

After that October 2009 financing, Tamir refocused its efforts on the “development of an anti-viral use for Onconase, contrary to the express purpose of the financing and to the detriment of the Phase II trial.”

“This shift in focus and other mismanagement by Tamir’s board and executives caused the cancellation of the Phase II trial in early 2011.,” the lawsuit states.

In the following months, Tamir notified McCash it was going to “entertain partners/buyers for its Onconase oncology platform.”

Tamir allegedly suggested if McCash was interested in buying the Onconase oncology platform, that he submit a proposal” including “detail (on) how the oncology asset would be valued,” the suit states.

However, during “the next several months” Tamir “refused to work with McCash in good faith” and allegedly did not provide vital information to McCash needed to “provide any such valuation or proposal,” the suit states.

During this same time around late March and early April of 2011, “Tamir suddenly decided that it would destroy certain components of its Onconase inventory and related materials on hand,” the lawsuit alleges.

The company stopped “making government agency filings because Tamir claimed it could not pay storage and other related costs,” the lawsuit states.

McCash opposed the “destruction of these assets” that “were part of the oncology platform McCash was interested in obtaining,” the suit explains.

Responding to McCash’s objection, Tamir CEO Charles Muniz alegedly asserted “that the company’s limited funds” needed “to be maintained for running its operations and completion of its primary objective,” the suit alleges

That objective was “ascertaining results of in vivo antiviral studies for various diseases.” Tamir’s “negotiations during this period were not in good faith,” the lawsuit charges.

“Hand-written notes indicate that Tamir was telling McCash “anything he want[ed] to hear” as long as McCash kept funding the company, the suit states. In December 2011, “Muniz was fired as Tamir CEO” and replaced with Larry Kenyon, interim CEO and CFO. McCash and Tamir “continued to negotiate a McCash acquisition of the oncology platform.”

By June 2012 “it became clear to McCash that Tamir and its leadership had failed in numerous respects to execute their duties and responsibilities,” the federal suit states. On June 26, 2012, McCash filed a lawsuit in Cook County Circuit Court in Illinois “alleging fraud and breach of fiduciary duty against Tamir.”

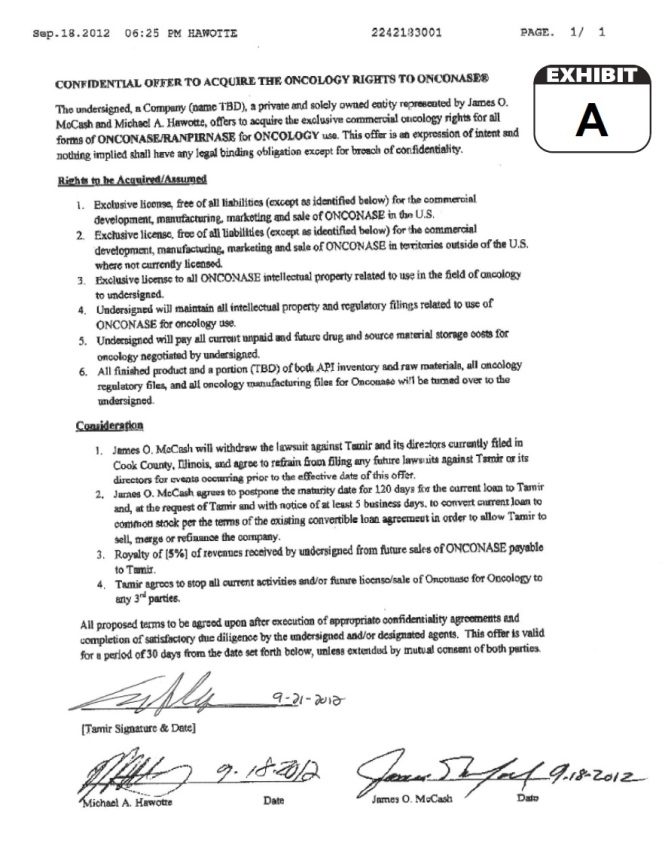

Between June and September 2012, McCash through “anticipated business partner” Michael Hawotte and Tamir Interim CEO and CFO Larry Kenyon, negotiated and came to an agreement in an attempt to resolve these issues and conflicts (hereafter, the “Agreement”).

“Hawotte and Kenyon communicated and negotiated via telephone and email … discussing and exchanging various terms and conditions, resulting in the Agreement,” the suit states.

“The Agreement between McCash and Tamir is memorialized in various documents” including a “Confidential Offer executed in September 2012 (Exhibit A),”the suit states.

“The Agreement between McCash and Tamir is memorialized in various documents” including a “Confidential Offer executed in September 2012 (Exhibit A),”the suit states.

That “Confidential Offer” was allegedly agreed upon between “September 14 and September 18, 2012” that the suits claims the “material terms of the Agreement.”

“Cash agreed to: (1) Drop the 2012 Lawsuit; and (2) convert five (5) loans (notes) made by Tamir and in favor of Michael McCash, David McCash,” the suit states.

(See below for more details the suit says are part of the agreements.)

However – the suit states agreement claims and participants including Mary McCash, Colleen Lowe, and Corinne Poquette:

However – the suit states agreement claims and participants including Mary McCash, Colleen Lowe, and Corinne Poquette:

“Prior to conversion under the Agreement, the Converted Notes had a value of $1,157,121.25,” the suit claims.

“The shares of Tamir stock which were received for the Converted Notes had effectively zero value at or shortly after the conversion.”

Tamir is a “biotechnology company engaged in the discovery and development of drugs, among other things,” the 13-page lawsuit states.

The complaint was filed on Dec. 30, 2016 in the United States District Court for the Western District of Michigan Northern Division by law firms in Marquette and Milwaukee, WI.

Then the (lengthy in details) suit explains more about the clinical trials and how they relate to the Mayo Clinic:

Following the dismissal of the 2012 Lawsuit and the conversion of the Converted Notes to stock, and based on the reasonable expectation that would Tamir uphold its end of the Agreement, Mr. McCash moved forward in several respects with regard to his plans to market and begin trials of Onconase.

Among other things, McCash held discussions with the Associate Chair, Corporate and Foundation Relations and Department of Development, at the Mayo Clinic in Rochester, Minnesota, that were centered upon the use of Onconase and its medical research opportunities that included a clinical trial for the second line treatment of mesothelioma, which would be conducted through the use of the items Tamir was to provide under the Agreement.

McCash also began forming partnerships with other third parties to assist in the management and financing of a 60 patient Onconase trial.

——-

The following is taken directly from the lawsuit as it involves lots of details of the alleged agreement – and others involved in the case.

Mary McCash, Colleen Lowe, and Corinne Poquette (the “Converted Notes”) into Tamir common stock.

Also per the Agreement, Tamir agreed to: (1) give McCash the exclusive license for the commercial development, manufacturing, marketing and sale of Onconase; (2) give McCash exclusive license to all Onconase intellectual property related to oncology use; (3) give McCash all finished product and a portion of both API (active pharmaceutical ingredient) inventory and raw materials, all oncology regulatory files, and all oncology manufacturing files (complete and in accordance with all regulatory requirements) for Onconase; and (4) provide McCash with a warrant to purchase 23,700,000 shares in Tamir at an exercise price of $0.01 per share.

By making the Agreement with McCash, Tamir made material promises and representations to McCash that it had both the ability and the intent to deliver on its end of the Agreement and that it could and would provide McCash all of the complete and up-to-date materials, files, etc.

Tamir knew that McCash intended to move forward with the development of Onconase, and that Tamir’s performance under the Agreement was required for McCash to do so.

Unlike a letter of intent offering a general statement with respect to a specific undertaking, the terms of the Agreement represented material, contractual terms agreed to by the parties.

The Agreement is even memorialized in SEC filings made by Tamir.

McCash upheld his end of the Agreement, as the 2012 Lawsuit was not pursued any further and ultimately dismissed; and, the Converted Notes were ultimately converted into Tamir stock.

On May 28, 2013, Dr. Jamie Sulley, President of Tamir, confirmed by written correspondence on behalf of Tamir, the terms of the Agreement, the existence of the regulatory files, eggs and canisters of API, and acknowledged that Tamir was required to supply these items as part of the Agreement.

On July 19, 2013, Mr. McCash received correspondence from Lois B. Voelz (“Voelz”), an attorney asserting to represent Tamir, which was made in response to a letter sent by Mr. McCash to Dr. Jamie Sulley on July 12, 2013.

In the July 19, 2013 correspondence from Voelz, McCash was informed that the Investigational New Drug Application (IND) was “inactive,” but would not commit to whether the regulatory files, eggs and canisters of API still existed.

Voelz further asserted in the July 19, 2013 correspondence, referring to a prior telephone call on June 20, 2013, that the September 18, 2012 Agreement “did not properly state the terms under negotiation” and that the parties would have to make a “fresh start with a new and comprehensive term sheet.”

McCash believed that the July 19, 2013 correspondence was vague, and did not agree with the proposition that the Agreement did not set forth the parties’ agreed upon terms.

Nevertheless, following the July 19, 2013 correspondence, McCash continued to act in good faith to work with Tamir to do whatever was needed to obtain the consideration Tamir agreed to provide under the terms of the Agreement.

This included reviewing several iterations of Tamir’s proposed “Term Sheet” and attempting to conduct due diligence, which specifically focused on whether Tamir, in fact, possessed the items it agreed to provide under the Agreement (i.e. a portion of API inventory and raw materials, all required oncology regulatory files, and all oncology manufacturing files for Onconase).

During the conduct of this due diligence, the question remained whether the of API inventory and raw materials, all oncology regulatory files, and all oncology manufacturing files for Onconase were still possessed by Tamir and could, in fact, be provided. Ultimately, Mr. McCash asked Attorney Voelz whether these items were still in Tamir’s possession.

On August 24, 2014, Ms. Voelz wrote to Mr. McCash and, addressing this question, responded that “the Company will not entertain your extraneous demands concerning company assets.”

Upon receiving the August 24, 2014 correspondence from Ms. Voelz, Mr. McCash discovered that as of that time, Tamir either could not or would not uphold its end of the Agreement.

FIRST CLAIM FOR RELIEF: Breach of Contract

McCash incorporates by reference and restates all allegations made in paragraphs 1 through 40 of this Complaint.

The Agreement represented a contract between Tamir and McCash.

Tamir failed to perform its duties under the Agreement, constituting a breach of contract.

Said breach of contract by Tamir caused McCash to incur pecuniary loss and damages in excess of $75,000.00 and in an amount to be determined at the time of trial.

SECOND CLAIM FOR RELIEF: Unjust Enrichment

McCash incorporates by reference and restates all allegations made in paragraphs 1 through 44 of this Complaint.

In reliance on Tamir’s promises under the Agreement, McCash performed his duties under the terms of the Agreement.

Tamir received the benefit of McCash’s performance

It is unjust for Tamir to retain the benefit of McCash’s performance without paying restitution to McCash.

Through Tamir’s failure to uphold its duties under the Agreement, it has been unjustly enriched.

The retention of these benefits by Tamir has resulted in an inequity to McCash. McCash has been damaged as a result of Tamir’s unjust enrichment.

McCash is entitled to damages for restitution in an amount in excess of $75,000.00 and in an amount to be determined at the time of trial.

THIRD CLAIM FOR RELIEF: Intentional Misrepresentation

McCash incorporates by reference and restates all allegations made in paragraphs 1 through 52 of this Complaint. . In making the Agreement, Tamir made certain material promises and representations to McCash, including those referenced above, regarding its assets and its ability and intent to perform its duties under the terms of the Agreement.

Tamir intentionally and knowingly made the aforementioned material promises and representations without the ability or intent to perform; therefore, the representations were false.

The aforementioned material promises and representations were made with the intent that McCash would agree to the terms of the Agreement and act upon his obligations thereunder.

McCash acted in reliance upon the representations made by Tamir in entering into the Agreement and performing his obligations thereunder, to his detriment.

Said misrepresentations by Tamir caused McCash to incur damages in excess of $75,000.00 and in an amount to be determined at the time of trial.

FOURTH CLAIM FOR RELIEF: Promissory Estoppel

McCash incorporates by reference and restates all allegations made in paragraphs 1 through 58 of this Complaint.

Tamir made various promises to McCash as part of the Agreement, as set forth above.

Tamir should have reasonably expected its promises under the Agreement to induce action by McCash of a definite and substantial character.

In fact, Tamir’s promises under the Agreement did induce action by McCash of a definite and substantial nature, as set forth above.

Tamir received the benefit of McCash’s execution of his duties under the terms of the Agreement.

Through Tamir’s failure to uphold its duties under the Agreement, it has been unjustly enriched.

Tamir’s retention of the benefit by Tamir has resulted in an inequity to McCash. These circumstances require enforcement of the promise made by Tamir if injustice is to be avoided. McCash is entitled to damages for restitution in an amount in excess of $75,000.00 and in an amount to be determined at the time of trial.

FIFTH CLAIM FOR RELIEF: Negligent Misrepresentation

McCash incorporates by reference and restates all allegations made in paragraphs 1 through 67 of this Complaint.

In making the Agreement, Tamir made certain material promises and representations to McCash, as referenced above, negligently and without reasonable care.

Tamir owed McCash a duty of care in making the aforementioned material promises and representations.

McCash justifiably relied on the aforementioned material promises and representations.

McCash’s reliance was to his detriment.

Said reliance on Tamir’s aforementioned negligently-made material promises and representations caused McCash to incur damages in excess of $75,000.00 and in an amount to be determined at the time of trial.

SIXTH CLAIM FOR RELIEF:Innocent Misrepresentation

McCash incorporates by reference and restates all allegations made in paragraphs 1 through 73 of this Complaint.

In making the Agreement, Tamir made certain material promises and representations to McCash, as referenced above.

The aforementioned promises and representations were made in connection with the making of a contract (i.e., the Agreement) between Tamir and McCash.

The aforementioned material promises and representations made by Tamir to McCash were false when they were made.

McCash would not have entered into the contract if Tamir had not made the aforementioned promises and representations.

McCash suffered loss as a result of entering into the Agreement.

McCash’s loss benefited Tamir.

The aforementioned caused McCash to incur damages in excess of $75,000.00 and in an amount to be determined at the time of trial.

WHEREFORE, Plaintiff, James O. McCash, demands a judgment from this Court ordering that:

Judgment against the Defendant for its actual damages, including direct and indirect damages, general and special damages, legal and equitable damages, consequential damages, damages relating to lost profits and punitive damages;

For court costs, fees and disbursements, including reasonable attorneys’ fees incurred in connection with this action;

Judgment enforcement fees; Pre and post judgment interest; and Any other relief to which Plaintiff may justly be entitled.

Filed by:

Richard T. Orton for Crivello Carlson, S.C.

George S. Peek

WI Bar No. 1041648

Richard T. Orton

WI Bar No. 1075733

Crivello Carlson, S.C.

710 N. Plankinton Avenue

Milwaukee, WI 53203

(p) 414-271-7722

(f) 414-271-4438

gpeek at crivellocarlson.com

rorton at crivellocarlson.com

Kendricks, Bordeau, Adamini, Greenlee & Keefe, PC

Brandon J. Evans

MI Bar No. P69576

Kendricks, Bordeau, Adamini, Greenlee & Keefe, PC

128 West Spring Street

Marquette, MI 49855

(p) 906-226-2543

(f) 906-226-2819

bevans at kendrickslaw.com

——-

Related info:

McCash Investment Management, Inc.

222 E Hughitt St.

Iron Mountain, Michigan

906-774-3550

http://david-mccash.lpladvisorsites.com

https://www.facebook.com/McCash-Investment-Management-Inc-194134920656842

——-

Northern Leopard Frog

http://www.reptilesmagazine.com/Care-Sheets/Northern-Leopard-Frog/

——-

Tamir Biotechnology, Inc., Defendant

Onconase – Ranpirnase

http://www.alfacell.com/products/onconase_profile.htm

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2586917/

https://en.wikipedia.org/wiki/Ranpirnase

https://www.cancer.gov/publications/dictionaries/cancer-terms?cdrid=335503

http://medical-dictionary.thefreedictionary.com/Onconase

https://www.mesothelioma.com/treatment/chemotherapy/onconase.htm

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2586917/figure/F2/